The fly project offers online training on financial education through an open educational resources platform.

The international Erasmus+ financial literacy project FLY – Financial Literacy for Inclusion, co-financed by the European Union, has now launched its training section https://www.fly-project.eu/training.php?lang=EN with all the training material developed by …

The international Erasmus+ financial literacy project FLY – Financial Literacy for Inclusion, co-financed by the European Union, has now launched its training section https://www.fly-project.eu/training.php?lang=EN with all the training material developed by the project partners, through the Open Educational Resources Platform (OER). With this initiative, all the courses designed to promote financial security are available to the public free of charge.

Users can access all the training material completely free of charge and without prior registration, through the link: https://www.fly-project.eu/training.php?lang=EN and easily navigate through the different modules and training areas, which will provide the keys to optimise the use of money and achieve greater autonomy in basic financial matters.

This resource is aimed at anyone who wants to acquire the skills to identify and assess situations related to their personal finances and make their own financial decisions.

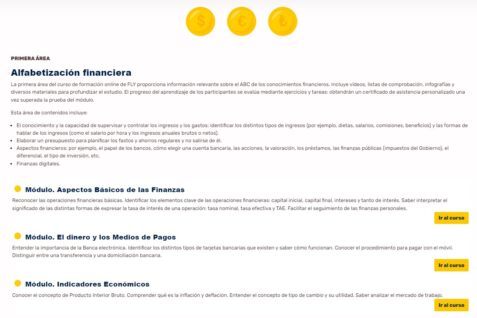

The content of the new online training tool is available in a multilingual version, having been translated into the five languages of the FLY project (English, Spanish, Italian, French and Turkish); and is divided into three main areas: Financial Literacy Alphabet; Financial Decision-Making and Management; and Finances for Good.

In the FIRST AREA, Financial Literacy Alphabet, the following modules are covered: Module 1: Fundamentals of finances; Module 2: Money and Means of Payment; Module 3: Economic Indicators.

In the SECOND AREA: Financial Decision-Making and Management, the modules: Module 4. Savings products: deposits; Module 5. Financing options, credits and loans; Module 6. Family / personal budget management; Module 7. Special products (i.e., reverse mortgage).

And in the THIRD AREA: Finances for Good, you will learn about the modules: Module 8: Financial advisory; Module 9: Risks and Dangers of Finance; Module 10: Ethical finance for a just society.

Through different training resources such as infographics, presentations, self-assessment tests, and a tool specially designed to measure the user’s financial knowledge, citizens can broaden their notions about the value of money and savings or about risk and the real needs of their economic decisions, be they savings, investment, indebtedness or transactions, for example. This training, validated by experts in the field, is aimed at targeting the best financial actions that have an impact on the preservation of the environment at the individual level.

The OER platform that hosts this material, as one of the pillars of the FLY project, as well as the rest of the project results, is developed by a consortium of eight organisations from five European countries (Belgium, Spain, France, Italy and Turkey).

From a digital transformation perspective, this group addresses financial literacy by supporting the use of digital technologies in adult education and promoting new learning opportunities, especially for people who need a higher level of financial knowledge, skills and competences.

The partners are currently engaged in the Testing and Validation phase of the training content, with a target of 140 final beneficiaries, including representatives of the target groups, professionals and educators, as a matter of fact, the curriculum will be delivered transnationally to a cohort of targets’ representatives and stakeholders of interest (i.e., both direct beneficiaries of the training content as well as other stakeholders operating in the fields of Adult education, digital and media literacy, etc.). An internal and common project plan for the roll-out in pilot version of the training content has agreed on by partners.

Find out more about Project FLY: